Important Information

About One Partner Limited (FSP403346)

Trading as Loan Spot | better finance™ | Motor Vehicle Finance

License Information

One Partner Limited (FSP403346), trading as Loan Spot, better finance™, and MotorVehicle Finance, holds a Class 2 Financial Advice Provider Licence issued by the Financial Markets Authority to provide financial advice.

Contact Details

One Partner Limited (FSP403346) is the Financial Advice Provider. You can contact us at:

Email: enquiries@loanspot.co.nz

Phone: 0800 666 022

Address: 14/987 Ferry Road,

Ferrymead,

Christchurch, 8023

Nature and Scope of Engagement

Vehicle Loans, Personal Loans and Debt Consolidation

New lending and refinance

One Partner Limited provides financial advice services for vehicle loans, personal loans and debt consolidation loans from the following providers (known as lenders):

|

|

Credit and Asset Insurance Products

One Partner Limited does not provide advice on Credit Insurance products (Lifestyle Protection Insurance and Guaranteed Asset Protection), or Asset Insurance products (Mechanical Breakdown Insurance).

If we provide the option of these insurances together with a personal loan, our services are limited to providing you with information to assist in making a decision and aiding you in obtaining the insurance(s). We provide information about Credit and Asset Insurance products from Provident Insurance and Quest Insurance.

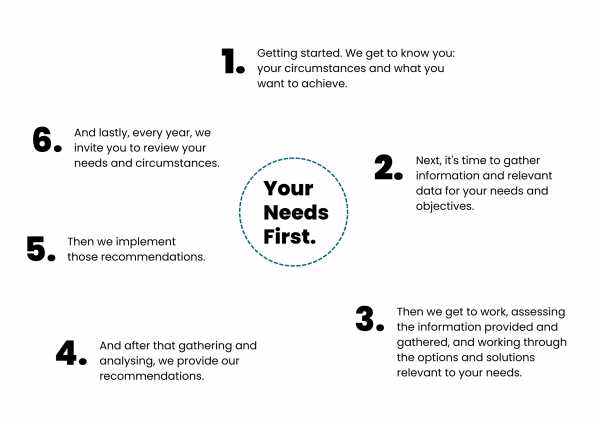

Our advice services: How we operate

To ensure that our financial advisers prioritise the client’s interests above their own, we follow a robust advice process to ensure our recommendations are made on the basis of the client’s goals and circumstances.

Conduct

One Partner Limited, and anyone who gives financial advice on our behalf, have duties under the Financial Markets Conduct Act 2013 relating to the way that we give advice.

We are required to:

-

Give priority to your interests by taking all reasonable steps to make sure our advice isn’t materially influenced by our own interests

-

Exercise care, diligence, and skill in providing you with advice

-

Meet standards of competence, knowledge and skill set by the Code of Professional Conduct for Financial Advice Services (these are designed to make sure that we have the expertise needed to provide you with advice)

-

Meet standards of ethical behaviour, conduct and client care set by the Code of Professional Conduct for Financial Advice Services (these are designed to make sure we treat you as we should, and give you suitable advice).

This is only a summary of the duties that we have. More information is available by contacting us, or by visiting the Financial Markets Authority website at https://www.fma.govt.nz.

Fees and Remuneration

Loans

One Partner Limited may charge an Introducer Fee of up to $995 and our lenders charge an Establishment Fee which can vary up to $350 depending on the Lender (you can find out more about Lender Fees here). These fees are added on to the loan amount you are borrowing.

One Partner may also be remunerated in either of these ways depending on the lender:

-

Commission: We may receive a commission from the lender when a loan is completed. The commission amount is either: (a) a percentage of the loan amount and will vary depending on the lender, or (b) a referral fee paid at settlement.

-

Interest Income: A portion of the interest payable by you to the lender based on the amount financed and the term of the loan, paid to us at settlement.

Insurance Products

If we help you obtain Credit or Asset Insurance from Provident Insurance, in conjunction with a vehicle or personal loan, we may receive a commission from that insurance provider.

Conflicts of Interest; Commissions and Incentives

One Partner Limited receives income from lenders. This income varies depending on the lender.

From time to time, product providers may also reward us for the overall business we provide to them. They may give us tickets to sports events, hampers, or other incentives. We maintain registers of conflicts of interests, and the gifts and incentives we receive.

We take any perceived or real conflicts of interest very seriously and have a dedicated policy for dealing with such issues whereby we avoid, disclose and/or manage any conflicts so that our client’s interests are placed first and foremost.

All our financial advisers undergo annual training about how to manage conflicts of interest. We undertake a compliance audit, and a review of our compliance programme annually.

Complaints handling and dispute resolution

If you are not satisfied with our financial advice service you can make a complaint by emailing enquiries@loanspot.co.nz or by calling 0800 666 022. You can also write to us at: 14/987 Ferry Road, Ferrymead, Christchurch, 8023

When we receive a complaint, we will consider it following our internal complaints process:

We will consider your complaint and let you know how we intend to resolve it. We may need to contact you to get further information about your complaint.

We aim to resolve complaints within 10 working days of receiving them. If we can’t, we will contact you within that time to let you know we need more time to consider your complaint.

We will contact you by phone or email to let you know whether we can resolve your complaint and how we propose to do so.

If we can’t resolve your complaint, or you aren’t satisfied with the way we propose to do so, you can contact Financial Services Complaints Limited (FSCL).

Financial Services Complaints Limited (FSCL) provides a free, independent dispute resolution service that may help investigate or resolve your complaint, if we haven’t been able to resolve your complaint to your satisfaction.

You can contact Financial Services Complaints Limited (FSCL) by:

-

emailing complaints@fscl.org.nz or

-

calling: 0800 347 257

-

can also write to them at: FSCL, PO Box 5967, Wellington 6140

-

or fill in the online complaints form: https://fscl.org.nz/about-us/complaints/complaint-form

How to get a printed copy

You can download a copy of this disclosure statement here.

Ask us - we are here to help...

We welcome any questions or queries you have in relation to this information.

Just get in touch on 0800 666 022 or enquiries@loanspot.co.nz.